SWP

SWP remains dull in relative terms compared to the rest of the dairy proteins market

Europe

SMP gets prioritized above SWP in competition for drying capacity

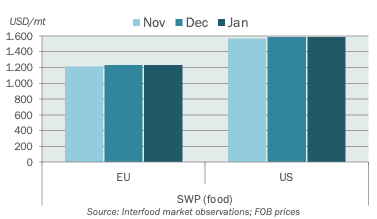

The heat in the global SMP market has so far had limited impact on the EU SWP market. The only direct impact that is felt in the whey market is the limited drying capacity for liquid whey as SMP manufacturing is now obviously prioritized. The ongoing price appreciation in WPC-80 and WPI where prices in both the EU and the US continue to break records is still a more important driver of whey market dynamics. Feed SWP is changing hands at EUR 1060 delivered the Netherlands, while food quality SWP is traded at EUR 1120-1220 in Eastern EU and EUR 1050-1250 in Western EU, ex works. The feed market still has to step in for Q2 but availability is expected to improve in months to come. It is difficult to get a sense of direction for the whey market but the upward potential seems to slightly outweigh the downward potential at the moment.

Americas

Demand is not strong enough to push prices to higher levels

Prices of the mid and top tier SWP brands remain in the USD 0.70-0.75/lb (1545-1585/t) ex works range. WPC-80 and 90 are still the preferred destinations for whey solids since prices continue to soar, but SWP prices are not pulled up in equal terms. Suppliers are not sold out but are getting increasingly confident due to the overall bullish developments in proteins. The floor may have lifted in dry whey but domestic demand is not strong enough to push prices higher. What’s also not helpful is the increased competition from EU origins despite the currency tailwind of the US dollar.

More insights

If you're interested in SWP, you may also like these topics: