Cheese

Cheese prices follow the overall upward trend of the dairy market

Europe

All three cheese markets are firming

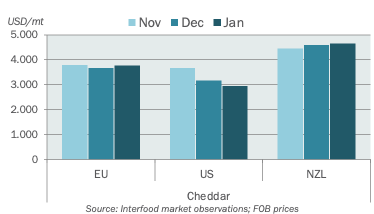

Commodity cheese markets in the EU are firming up and prices continue to appreciate. In relative terms Mozzarella feels the tightest of the three commodity types and Cheddar the least tight. Exports of Mozzarella and Cheddar are doing well although EU origins have lost out in terms of relative competitiveness since mid-January due to the appreciation of the Euro against the US dollar. Most Gouda is traded at a relatively young age which underlines the tightness of the market. Prices are at EUR 3200-3250. Mozzarella is traded at EUR 3150-3200 with Southern EU buyers in particular stepping in for Q2 deliveries. Cheddar is traded at EUR 3300-3350 for both UK and Eastern EU origins. Ireland is not in the market yet and manufacturers mention that the season may start slightly late due to the current wet weather conditions. All prices are ex works.

Americas

Price surge in protein creates ripple effect into cheese

With cheese being the backbone of the US dairy industry it comes as no surprise that the prices are rising as well. However, the cheese price correction is less strong than in the milk powders, with futures going up by some 5-10%. This early in the year domestic consumption is steady and with the fundamental supply situation continuing to be good a further growth in demand would be needed to move prices beyond the current levels. Colored blocks are sold at prices of USD 1.40-1.49/lb (3085-3285/t) and white blocks trade in the range of USD 1.50-1.59/lb (3305-3505/t) both ex works. Exports of Cheddar and Mozzarella are decent and needed to keep the market balanced. Mozzarella producers are generally comfortable about their Q1 sales book and are beginning to look at Q2. Cheddar supply in the Midwest and Southwest is strong but uncommitted supply is not that plentiful. With the approach of the season the availability will likely improve.

More insights

If you're interested in Cheese, you may also like these topics: