Cheese

US cheddar continues to rule the export game

Europe

Mixed picture: mozzarella weaker than gouda and cheddar

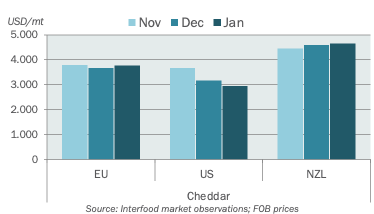

The EU cheddar market price has not really changed in the past four weeks, even though the pressure to sell is growing. At the current price of EUR 4550-4600 ex works the export market is totally out of reach and the domestic demand is relatively quiet. The gouda market is a little more oversupplied. Exports are out of the question at the current exchange rate and as a result the spot price has dropped by EUR 100-150 vs early June to EUR 4150-4200 ex works for spot deals. There is a lot of gouda that is still looking for a home in July and August. The mozzarella market has been the weakest of the three in this past month, as the buyside has been surprised by the large number of offers that flooded the spot market. Many suppliers that had been taking it easy all year were in the market and the prices dropped to EUR 4030-4100 ex works for spot deals and EUR 4100-4150 for Q3 delivery. Several buyers saw this as an opportunity to secure deals also for Q4 but the sell-side is generally not willing to bite at that period at these levels.

Americas

Slow domestic demand further boosts export potential

The US cheddar price has softened considerably during the month of June, but it has now recovered to a level of around USD 1.68/lb (3705/t) ex works for colored blocks. Domestic supply is good though not overwhelming but domestic demand has been weak. White cheddar continues to be very well received on the world market, at prices in the high USD 1.80s to low USD 1.90s/lb (about 4190/t) ex works. At this level it has a competitive advantage of at least USD 700 vs Oceania cheddar and even more than USD 1000 compared to EU product, excluding shipping costs. This clearly keeps all importing parties keenly looking at US origin. The new cheese plants in the US are not running up to the anticipated speed yet and the effect on milk prioritization and valorization is so far not fully clear.

More insights

If you're interested in Cheese, you may also like these topics: