SWP

US market feels firmer than the EU market

Europe

Market feels slightly weaker

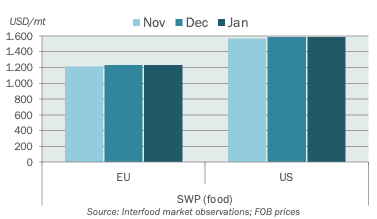

In the current phase of the market parties are wondering whether it is sentiment that is driving prices down or fundamental pressure. Feed buyers still purchase but volumes on offer are bigger than what’s required. Feed SWP is priced at EUR 810-820 delivered Netherlands. Food SWP feels slightly weaker with the price range widening to EUR 900-1180 ex works. There is still demand in the market, but calling the market firm would be an overstatement.

Americas

Prices continue to creep upward

SWP prices drifted a bit but on balance prices moved slowly upward due to output of new cheese expansions ramping up slower than expected. There is nothing particular to report on SWP demand but demand in those products that compete for the liquid whey – WPC80/90 in particular – is solid so the overall market balance remains tight. SWP is currently mostly traded at USD 0.55-0.60/lb (1210-1320/t), which is again slightly higher than last month.

More insights

If you're interested in SWP, you may also like these topics: