SMP

Relative stability in the protein side of the dairy complex

Europe

Clear downward price trend

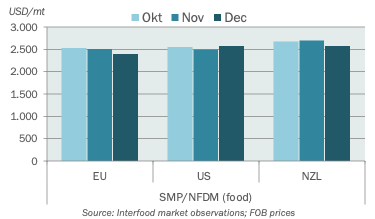

The EU SMP market is weak. The milk supply is more abundant than suppliers had anticipated in the past two months when they decided to lean back on sales, hoping that the price drop would come to an end. This hope for a turnaround is now gradually being abandoned, but the strength of the euro-dollar exchange rate made a further price drop necessary to maintain access to the world market. At the current price of EUR 2000-2050 ex works EU powder is competitive, but at this point most of the buyside is comfortable enough to go into holiday mode, knowing that the volumes will still be around after new year. There is no indication that dairy farmers in the EU will begin to curb production any time soon and thus the downward price potential may well continue a little while longer.

Americas

NFDM prices do not budge

For yet another month we repeat the statement that the spot price for NFDM continues to remain remarkably resilient, despite the ongoing negative sentiment further forward. Good demand both domestically and from Mexico created another squeeze on the spot market at prices that are even 3 cts higher than we quoted last month, they are now at USD 1.16-1.17/lb (2570/t) ex works. Milk production is expected to remain strong, particularly against weak last year comparables, but stocks are virtually absent and it is almost impossible to find sizeable offers. Cheese manufacturers prefer using powder as additional protein input due to the big spread between Class III and IV milk prices. Condensed skim is currently more expensive than powder for the first time in a while. Milk production starts to increase seasonally now and the probability that the negative forward sentiment will begin to take its effect on prices continues to increase.

Asia-Pacific

Market is quite balanced

The SMP price in the APAC region is relatively stable around a level of USD 2575 FOB. There is some urgent demand from Indonesia for food relief after the flooding of early December, but other than that most of the demand side is covered into the first part of Q1. Australian SMP has been well sold and processors there are relatively comfortable about their positions. For most of the buyers in APAC the price differential with EU powder is not large enough to trigger them to abandon their preference for Australian and New Zealand origins, which they perceive as superior quality and that have shorter transit times.

More insights

If you're interested in SMP, you may also like these topics: