Butter

Are the US exports finally coming to an end?

Europe

EU butter prices are affected by the sentiment in SMP

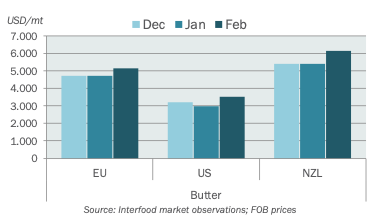

All during January the EU butter market was relatively quiet and relaxed. There was good availability and many suppliers had volumes on offer for nearby delivery. This changed when the EU SMP market caught fire early February. The sentiment in butter changed overnight and prices started to skyrocket. Most of the fundamentals remain unchanged though, with one important exception: EU butter exports are soaring now that the US market has tightened. Premium brands are in good demand for exports now. Buyers in the EU fear that they have missed the bottom price level and many of them are in a state of frenzy. It is almost impossible to quote a price level right now as it has been appreciating at such a high speed. In the second week of February the price appears to be settling around EUR 4200-4500 ex works.

Americas

US butter price moves sharply upward

In the last three weeks the price for US butter has been appreciating steadily. The spot price is now almost USD 1.60/lb (around 3525/t) ex works, and fresh new crop butter generates a premium of at least USD 10-20cts/lb. In unison the forward prices moved up, with the August level lifting to around USD 2/lb. Evidently, the old crop butter price reached such a low level in January that it became an interesting ingredient for processers. There were two reports published recently that underpinned the bullish sentiment, as stock levels appeared smaller than anticipated and export volumes exceeded expectations. These two combined further fueled the buyside’s fear that the past year’s butter exports are about to create tightness in the domestic market. Add to this the pull on protein that the US markets are currently witnessing and all of a sudden market participants seem to remember that historically the US has always been a net importer of dairy fats instead of the exporter it has been during most of 2025.

Asia-Pacific

Prices appreciate a little but market remains relatively calm

The fat market in APAC is relatively stable, when compared to the market situation in the protein-rich products. During the butter/AMF price fall in the second half of 2025 most of the buyside has taken the opportunity to increase their forward coverage to the extent that there is much less urgent demand right now. Chinese buyers remain very active supported by attractive downstream margins in butter. For AMF China is a major destination as well, but buyers from SE Asia and the Middle East are also showing consistent interest. Post GDT the AMF price is around USD 7000 and butter trades at USD 6150, both ex works and for Q2 delivery.

More insights

If you're interested in Butter, you may also like these topics: